Key Performance Indicators

Department of Revenue

Mission

The mission of the Department of Revenue is to collect, distribute and invest funds for public purposes. Alaska Constitution Article 9; Alaska Statute (AS) 25.27, AS 37, AS 43

Key Performance Indicators

| FY2024 Management Plan as of 04/24/2024 (in thousands) | |||||||||

| Department of Revenue Totals | Funding | Positions | |||||||

| UGF Funds | DGF Funds | Other Funds | Federal Funds | Total Funds | Full Time | Part Time | Non Perm | ||

| $28,893.9 | $2,417.7 | $412,740.6 | $153,968.5 | $598,020.7 | 835 | 24 | 23 | ||

| ||||||||||||||||||||||||||

| 2: |

Funds Distribution

Distribution activities for the Department of Revenue include but are not limited to: Permanent Fund Dividend Division distribution of Permanent Fund Dividends to eligible Alaskans, Child Support Services distributing payments to the custodial parent, and Tax Division distributing shared taxes to communities. |

Funding | Positions | ||||||

|

UGF Funds |

DGF Funds |

Other Funds |

Federal Funds |

Total Funds |

Full Time |

Part Time |

Non Perm |

||

| $4,640.5 | $1,033.8 | $68,628.6 | $61,251.8 | $135,554.7 | 286 | 11 | 9 | ||

- Target: Increase disbursements of child support payments by 0.5%.

- Target: Maintain or reduce administrative costs from year to year.

- Target: Increase Senior Housing units

- Target: Increase Multi-Family units

| 3: |

Funds Investment

Funds Investment activities for the Department of Revenue include but are not limited to: Permanent Fund Corporation investment of the fund, Treasury and Alaska Retirement Management Board (ARMB) investment of the state"s funds and retirement systems, and Alaska Mental Health Trust Authority (AMHTA) and Alaska Housing Finance Corporation (AHFC) cor |

Funding | Positions | ||||||

|

UGF Funds |

DGF Funds |

Other Funds |

Federal Funds |

Total Funds |

Full Time |

Part Time |

Non Perm |

||

| $2,113.0 | $292.5 | $281,243.9 | $17,735.0 | $301,384.4 | 135 | 3 | 4 | ||

- Target: For the funds under the fiduciary responsibility of the Commissioner of Revenue, exceed the applicable 1-year target returns.

- Target: A long-term 5% real rate of return

- Target: Formal visit, bond issue update, or updated document template sent or presented to ratings agencies at least four times per year.

- Target: 100% of new financings will result in savings or diminished administrative effort.

| 4: |

Safety for Alaskans

The Long Term Care Ombudsman is located with the Alaska Mental Health Trust Authority and performs investigations of complaints regarding Alaskans in long term care who may be experiencing a negative care situation. |

Funding | Positions | ||||||

|

UGF Funds |

DGF Funds |

Other Funds |

Federal Funds |

Total Funds |

Full Time |

Part Time |

Non Perm |

||

| $539.4 | $0.0 | $422.8 | $0.0 | $962.2 | 6 | 0 | 0 | ||

Performance Detail

| Priority 1: Funds Collection |

Target #2: 90% of existing taxpayers file their tax returns and make tax payments timely..

TRMS has a public facing component which allows taxpayers to file and make payments online. The Tax Division has had great success with this system and believes it is a factor in the performance reported. Target Last Modified: 10/30/2023 |

Target #3: Increase child support collections by 1.0%, to include Permanent Fund Dividend collections..

The division met and exceeded the target of a 1% increase over FY2022 due to the extra rebate paid out in the 2022 Permanent Fund Dividend payment. Target Last Modified: 10/25/2023 |

Target #4: 1,000 hour increase in audit hours over prior year..

The Tax Division strives to increase its year-over-year audit hours in an effort to be more efficient with its time and spend auditor time on things that will generate the greatest benefit to the State. The Tax Division began design and development of its TRMS in April of 2013. In order to ensure that implementation was successful, the Tax Division deliberately cut back on the number of audits conducted and diverted those resources to the implementation of TRMS. Full implementation of TRMS was completed in February of 2016. The project took a lot of our audit staff time in design and testing at various stages. The decrease in audit hours in FY2013 - FY2015 is a result of diverting resources to TRMS. The decrease in hours in FY2017 - FY2018 can partially be explained by the fact that there have been significant changes in the oil and gas production tax regime which has required programming changes to TRMS. The oil and gas production tax and corporate income tax Audit Groups remain current on all oil and gas audits. Target Last Modified: 10/30/2023 |

| Priority 2: Funds Distribution |

Target #1: Increase disbursements of child support payments by 0.5%..

The division is focused on improving processes and implementing technology to continue to meet our target increase of 0.5% in child support disbursements. Target Last Modified: 10/25/2023 |

Target #2: Maintain or reduce administrative costs from year to year..

* FY2023 appropriation does not reflect $2,000,000 appropriated for security upgrades. Subsequently, after security upgrades were made, $1,500,000 was returned to the fund as the security solution selected was a more cost-effective choice. Target Last Modified: 10/25/2023 |

Target #3: Increase Senior Housing units.

Renovating properties to allow for aging-in-place, through accessibility modification upgrades (loans or grants) may assist in relieving the overall demand for senior housing as demographics continue to grow. Encouraging Alaskans to complete home modifications, perhaps while they are still working and can more easily afford the repairs, will assist in assuring residents can remain in their homes and communities for as long as possible. Note: Unit data excludes AHFC mortgage data to assisted living properties as those developments report beds rather than units. Target Last Modified: 10/12/2023 |

Target #4: Increase Multi-Family units.

Target Last Modified: 03/29/2023 |

| Priority 3: Funds Investment |

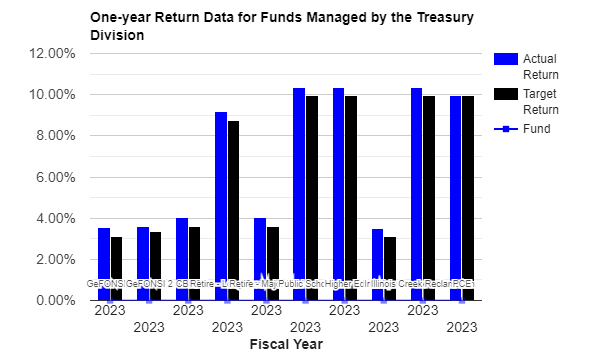

Target #1: For the funds under the fiduciary responsibility of the Commissioner of Revenue, exceed the applicable 1-year target returns..

Target Last Modified: 10/25/2023 |

Target #2: A long-term 5% real rate of return.

The Board of Trustees" long-term investment objective for the Fund is to generate total returns over Inflation/CPI plus 5%, with acceptable levels of risk. The Board has defined an approved risk guideline to delineate the absolute and relative risk staff may take to achieve these investment objectives. The Fund is invested across eight asset classes in both public and private markets to achieve this goal. The portfolio is designed to deliver compelling long-term returns under a variety of potential market conditions. The Alaska Permanent Fund"s (APFC) long-term rolling 10-year Real Rate of Return for the fiscal year period (FY) 2014-2023 was 5.9% with an inflation rate of 2.5%, and the Total Rate of Return for the same period was 8.3%. The Fund"s annualized total return for 39.5 years, ended June 30, 2023, was 8.7%. For FY2023, the Fund ended the year with a value of $78.0 billion in assets under management (AUM). This comprises $67.5 billion in the Principal of the Fund and $10.5 billion in the Earnings Reserve Account (ERA). The portion of dedicated State of Alaska revenues deposited into the Fund"s Principal (or "corpus") is based on mineral prices and production. In FY2023, this amount came in at $754 million and included $198 million in statutory deposits from FY2018 and FY2019 that were not appropriated at that time. Target Last Modified: 10/20/2023 |

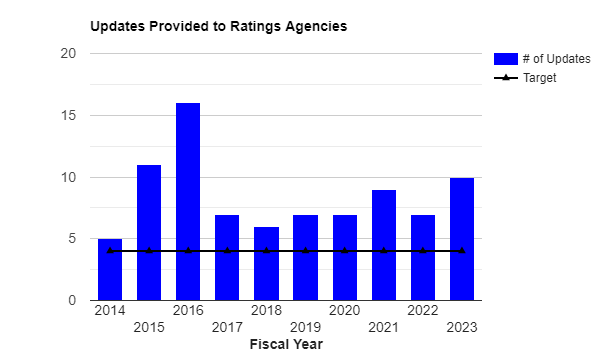

Target #3: Formal visit, bond issue update, or updated document template sent or presented to ratings agencies at least four times per year..

Target Last Modified: 10/25/2023 |

Target #4: 100% of new financings will result in savings or diminished administrative effort..

Target Last Modified: 03/29/2023 |

| Priority 4: Safety for Alaskans |

Target #1: 90% of all complaints received by the LTCO program are resolved to the satisfaction of the resident or their representative..

Who filed complaints to the LTCO program in FFY 2022: 54% of complaints received were from residents in facilities; 18% of complaints were reported by resident representatives, or family members; 28% of complaints were initiated by representatives of other agencies and all other complaints came from facility staff, friends of residents and other concerned citizens of the community. Target Last Modified: 10/20/2023 |

Last refreshed: 04/24/2024 05:00 pm